It is time to look forward to the market prosperity in the new year. After publishing concerns about the next stage of the market several times, the latest post by market research company LightCounting turned the past, pointing out that some negative factors in the past have begun to reverse, and gave light. Eight reasons device manufacturers are optimistic about the market next year.

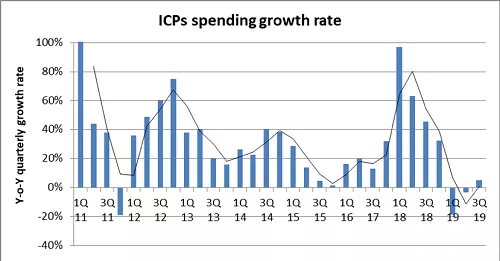

First, starting in the third quarter of this year, spending on super data centers has begun to recover and is about to enter a new high-growth cycle. Another market research company, Dell Oro’s latest Q3 report, noted that ten major cloud service providers spent $ 17.9 billion in data centers this quarter, a 14% year-on-year increase. New data centers and server upgrades will drive further increases in data center spending next year;

Second, the sales of datacom equipment manufacturers have started to stabilize and are expected to achieve positive growth. Sales of H3C and Inspur in the third quarter increased by 39% and 23%, respectively;

Third, the sales of optical device companies as a whole will reach a record high in the fourth quarter. The sales of the optical device industry in the past six months increased by 13% year-on-year, and it is expected to increase by 19% next year;

Fourth, the scale deployment of 5G starting in the third quarter of this year will stimulate the demand for 10G, 25G gray and IP light modules. LightCounting predicts that the wireless business optical module sales in 2019 will double year-on-year, and the average annual growth in the next 5 years will reach 20%;

Fifth, the sales of DWDM optical modules in the second half of 2019 are expected to increase by 11% year-on-year and 7% throughout the year. DCI and access network applications are the main driving forces. The former mainly requires coherent optical modules and the latter is 10G modules;

Sixth, represented by the deployment of 64Gbps Fibre Channel and 10G PON, network operators have begun to deploy higher-speed equipment, which also gives optical device manufacturers higher sales opportunities;

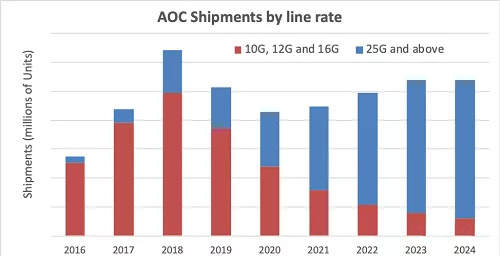

Seventh, various optical interconnection needs bring more new opportunities. In the second half of this year, the sales of optical interconnection products increased by 14% year-on-year, and the growth rate in the next five years will reach an average annual rate of 27%. In addition to data center applications, high-performance computing, core router connectivity, and even military, industrial applications are also included. According to the AOC and Embedded Optical Module EOM report subsequently released by LightCounting, the introduction of the new 400G technology will drive the AOC market to increase by 20% or more in 2023 compared to 2018, but the number will decrease by 43%, mainly due to Chinese data The impact of the reduction in the demand for 1xN AOCs by central operators;

Eighth, the increase in sensing applications has brought more demand for optical devices, including mobile phone 3D sensing, lidar, AR / VR, etc .;

In the field of optical communications market research, LightCounting’s report is timely and fickle. From the megatrends and some details, we have reason to believe that these eight reasons they gave in the post, but some unfavorable factors in the macro environment have not been eliminated. 5G applications are still unclear, and maintaining the necessary caution is still needed.